Bank of Canada rate decision and how it effects the Oakville, Burlington, and Milton Real Estate Markets

December market update

Happy holiday season to all of you. This month’s report illustrates the importance of local intelligence versus national real estate data.

This is the time of year where all the major banks reflect over the past year and prognosticate for what the future may have in store for financial markets all across the world. The older I get, the more sides to the story I like to get before I form my own opinion. Looking at the vast majority of Canada’s top economists employed by Canada’s major banks there is a consensus that the Bank of Canada will raise its rate to a maximum of 4.25% and that is where we are now as of this morning. As we all know, inflation is a lagging indicator so the Bank of Canada won’t know how much is enough and how much is too much until their rate hikes have had 9-12 months to work their way through the entire economy but there is a widely held opinion that Tiff wants to hold off and let the effects of the high rates take place. Will we see interest rates drop? Yes I think we will by the start of 2024. Will they get back to 1.25%? No I don’t think so. The bank of Canada wants inflation at 2%. A bank rate of 1.25% might be too low to achieve a stable rate of 2% inflation. CIBC thinks a bank rate of 3% is most likely what it will take to get there, so maybe there is a chance that we start to see some rate cuts in 2024 down from 4.25% to maybe 3%.

The following are the latest interest rate and bond yield forecasts from the Big 6 banks, with any changes from their previous forecasts in parenthesis.

|

|

Target Rate: Year-end ’22 |

Target Rate: Year-end ’23 |

Target Rate: Year-end ’24 |

5-Year BoC Bond Yield: Year-end ’22 |

5-Year BoC Bond Yield: Year-end ’23 |

|

4.25% (+25bps) |

4.50% (+50bps) |

3.75% |

3.85% (+25bps) |

3.45% (+25bps) |

|

|

4.25% |

4.25% |

3.00% |

NA |

NA |

|

|

4.25% (+25bps) |

3.75% (+25bps) |

3.00% |

3.40% (-15bps) |

3.15% (+20bps) |

|

|

4.00% |

4.00% |

NA |

3.45% (+10bps) |

2.95% |

|

|

4.25% |

4.00% |

3.00% |

3.90% |

3.55% |

|

|

4.25% |

3.25% |

NA |

3.70% |

2.55% |

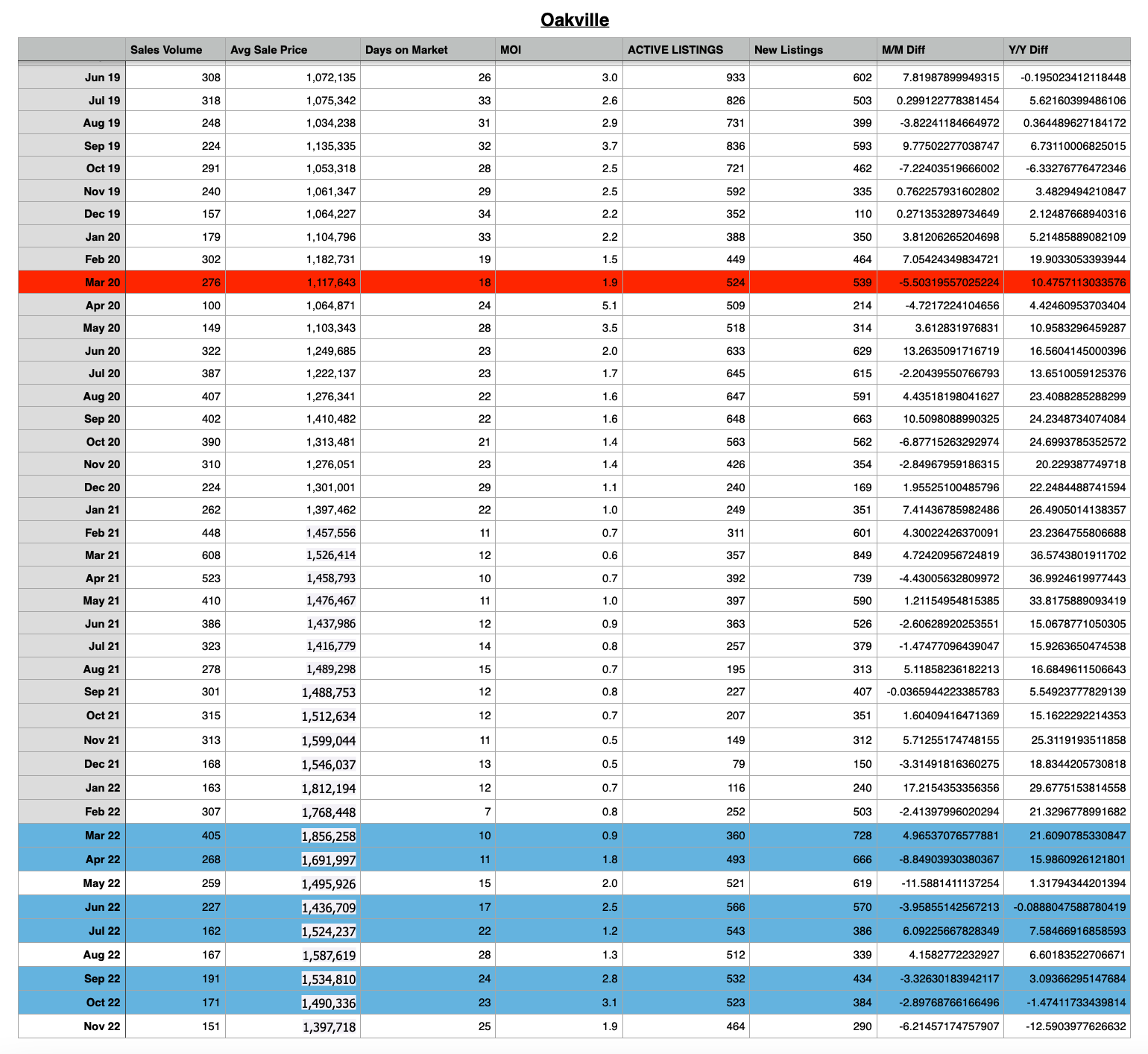

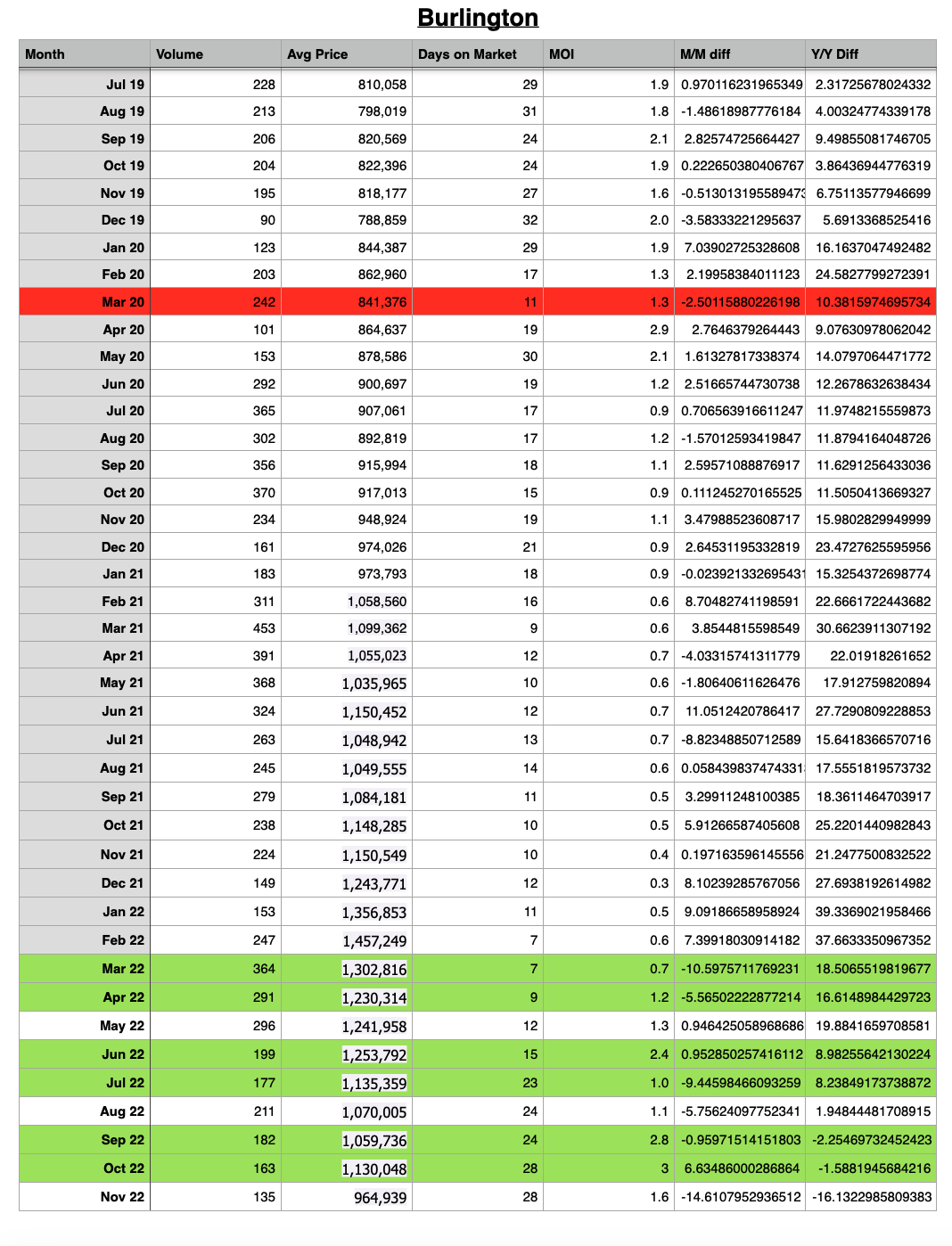

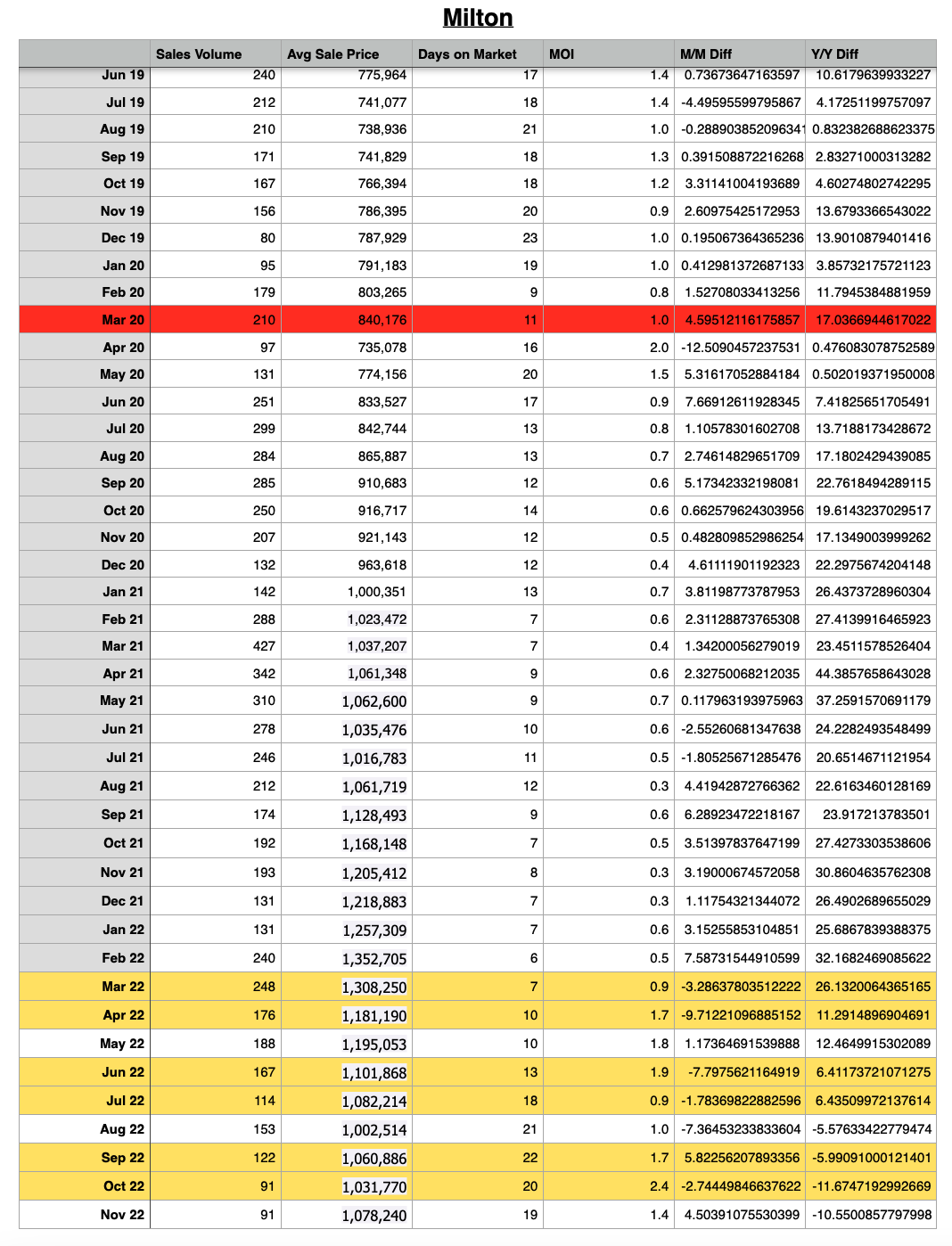

Why am I such an interest rate nerd? Because the rate has an inverse relationship to real estate prices. Interest rate goes up, real estate prices go down. Interest rate goes down, real estate prices go up. When you look at my data sheets, I have coloured in the months in which we have had interest rate increases (except the red one which was a full 1% decrease). You can see what happened to the average prices following rate increases.

Clearly there’s a very good chance that the rates will be fairly flat in 2023 and therefore the real estate prices should also be flat. There’s also a very good chance rates will drop in 2024 and as such real estate prices will increase in 2024.

If you are thinking about purchasing a property and you have researched different mortgage types, you will likely have been a little surprised to see that variable rates (which are normally lower than fixed rates) are the same or even higher than fixed rates. This little talked about phenomenon speaks volumes to me. When variable rates are sold at a discount the banks are betting that rates will increase, since they rarely decrease we are accustomed to seeing that discount. Now it’s “cheaper” to lock in for 5 years at the highest rate we’ve seen in years.

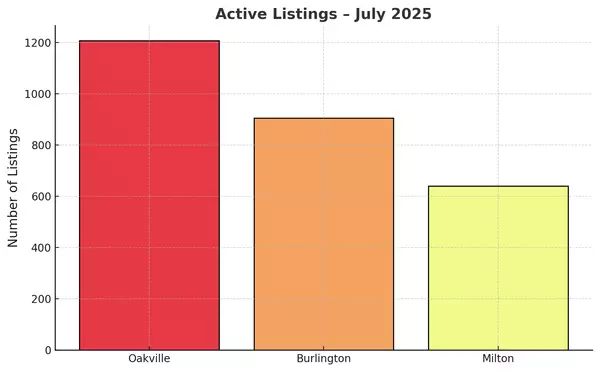

Remax Canada has predicted a 3% decline in prices across Canada and a 10% decrease in the GTA in 2023, specifically mentioning a 20% peak to trough delta. In Oakville, Milton, and Burlington we are are already at a 20% decline from peak to trough. In fact we are down 34% from our peak of $1,457,000 in Feb 22 in Burlington to $965,000 in Nov 22. In Milton we are down 20% from our peak of $1,352,700 in Feb 22 to $1,078,240 in Nov 22. In Oakville we are down 25% from our peak in Mar 22 of $1,856,258 to $1,397,718 in Nov 22.

Much like 2019/2019 we are entering a period where the bank of Canada is at the end of a rate hike cycle and our average prices are at their lowest point in 8 months. These high rates are temporary and the low prices are also temporary but are likely to stay this way for most of 2023 or until the Bank of Canada decides to cut rates (whichever comes first). It lends to reason that buying at a low price with a variable rate could be the most beneficial strategy for 2023.

Downsizers may want to hang in there a while longer until prices rise again, but if you are in a position to purchase that downsized home now and rent it out until you are ready to sell your more expensive home you could benefit from both markets.

One thing to keep in mind is that real estate is hyper local. Even if two houses are on the same street with the same dimensions, built on the same day 30 years ago, they could be priced vastly differently from one another based on other attributes such as recent renovations (the quality of the renovations), lot size and location (backing onto woodlands or green space). There are always certain properties that are less negatively effected by market dips and these same properties are also more positively effected by hot markets and it’s my job to find them for you.

If you or anyone you know is having any thoughts of buying or selling over the next 12-18 months please reach out to me, it’s never too early to be prepared. 905-399-4269.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts