How can real estate prices stay this high when the interest rate has climbed so high in the last year and a half?

Immigration without creating enough housing to support the immigration.

Like ordering a large milkshake in a small cup. (who does that??)

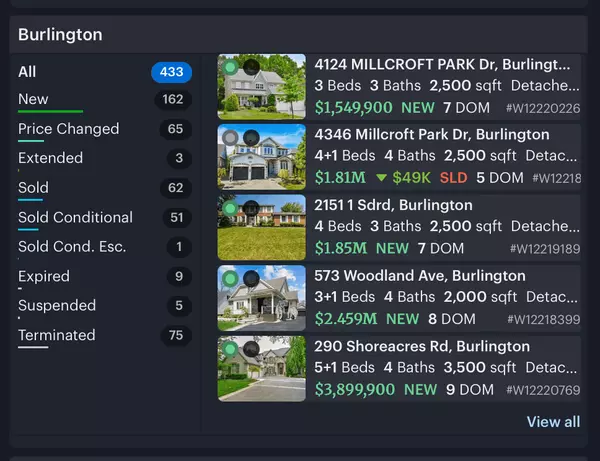

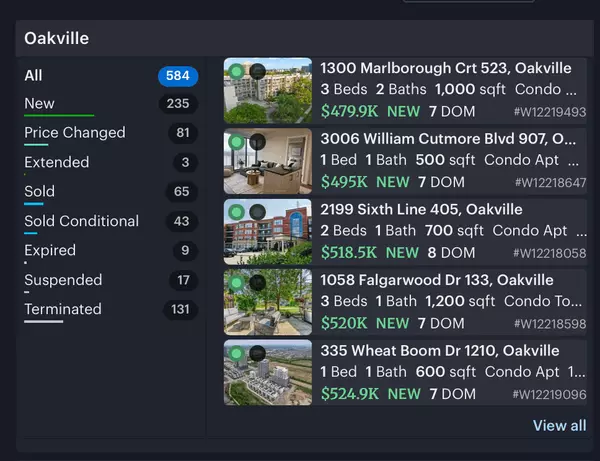

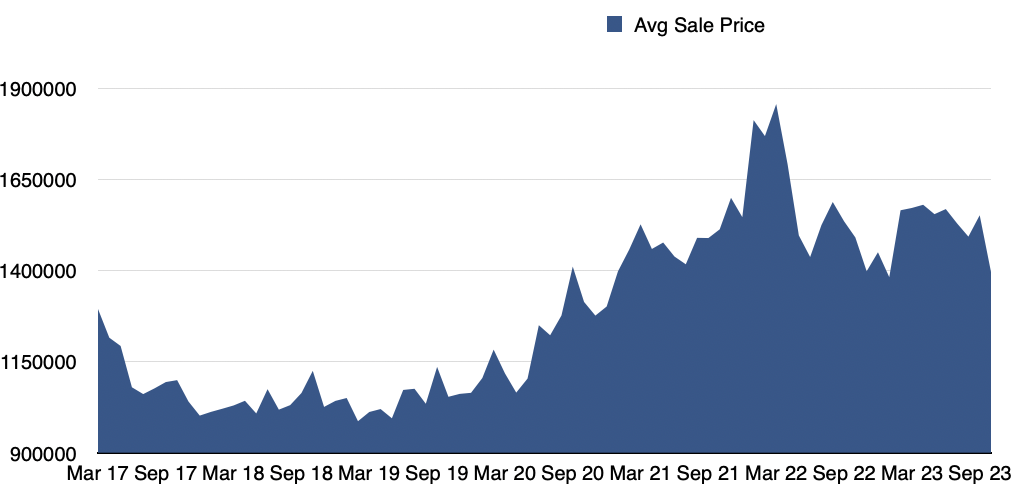

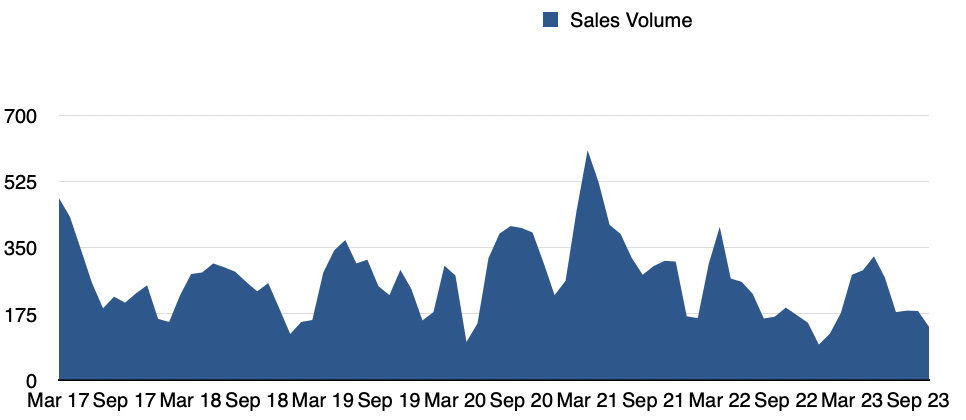

Oakville saw a large drop in the number of freehold homes sold and particularly in the $3m plus range contributing to a 10% drop in average price and a 22% drop in sales activity.

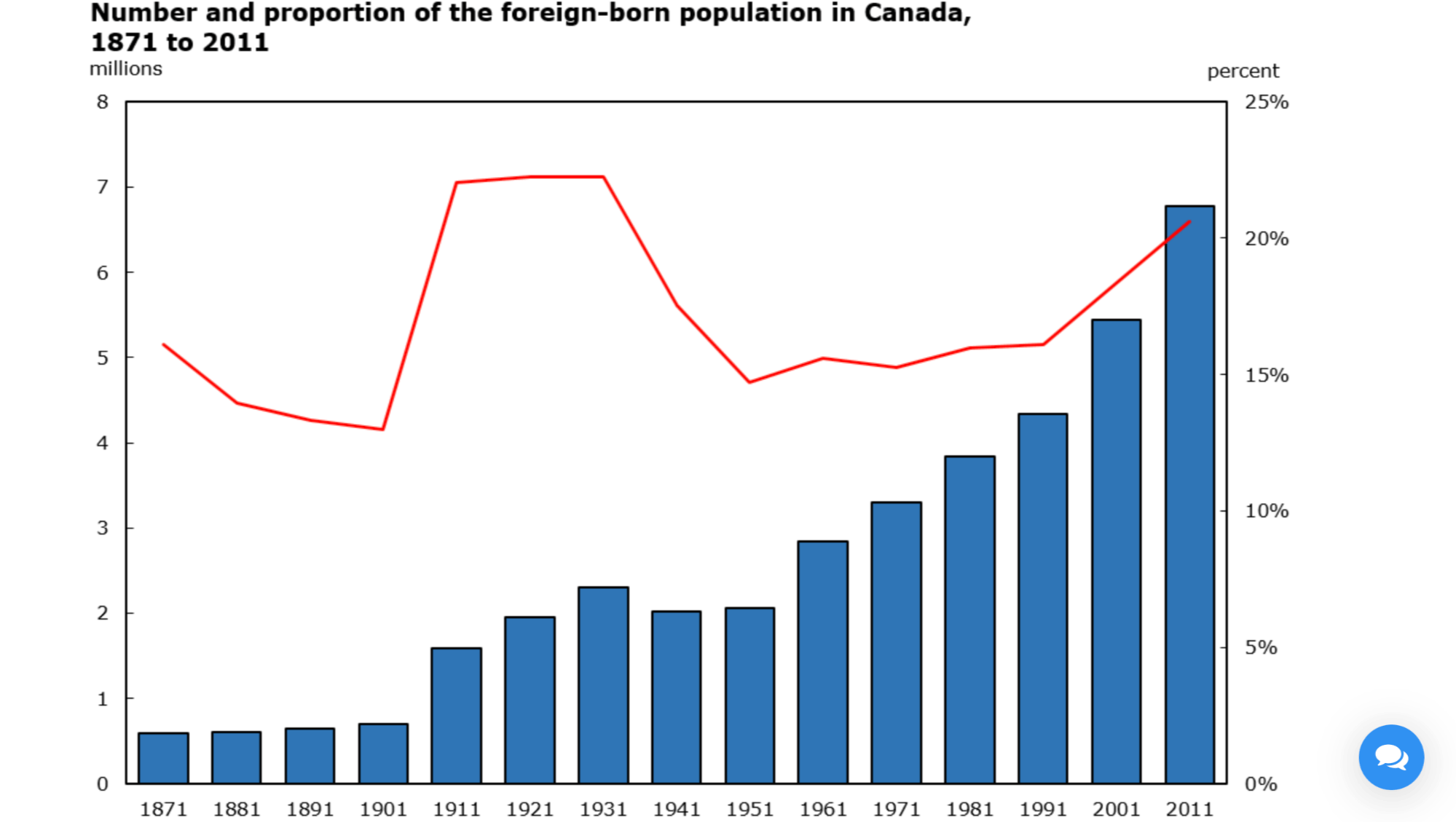

From 1961 to 2011 the number of immigrants grew from under 3,000,000 to 7,000,000 with the bulk of them settling in Ontario. In 1961 Canada's population was 18,273,000 compared to today at 38,781,000. There have been 11,376,086 housing completions during the same time period.

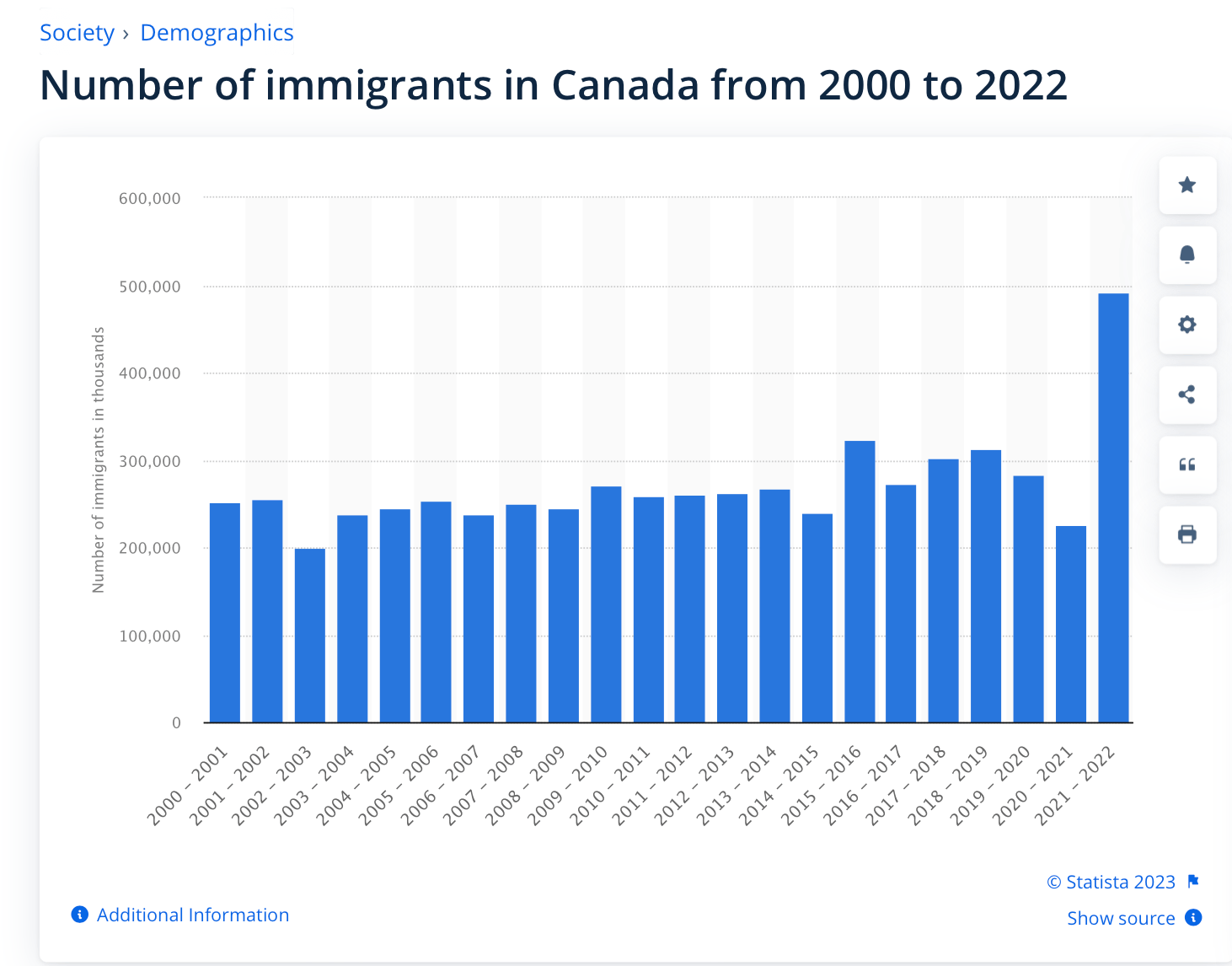

We have been traditionally hovering in the mid 200,000's here in Canada for new immigrants but that changed in 2016, 2018, and 2019 cracking the 300,000 mark, then dipped a bit during the covid years of 2020 and 2021 before coming back with a vengeance in 2022's 500,000 new immigrants to Canada. The government's forecast for the coming years is to stabilize at around 500,000 per year. Where are they going to live?

Senior Deputy Governor of the Bank of Canada Carolyn Rogers, was quoted in the Globe and Mail just after the Bank's most recent rate decision:

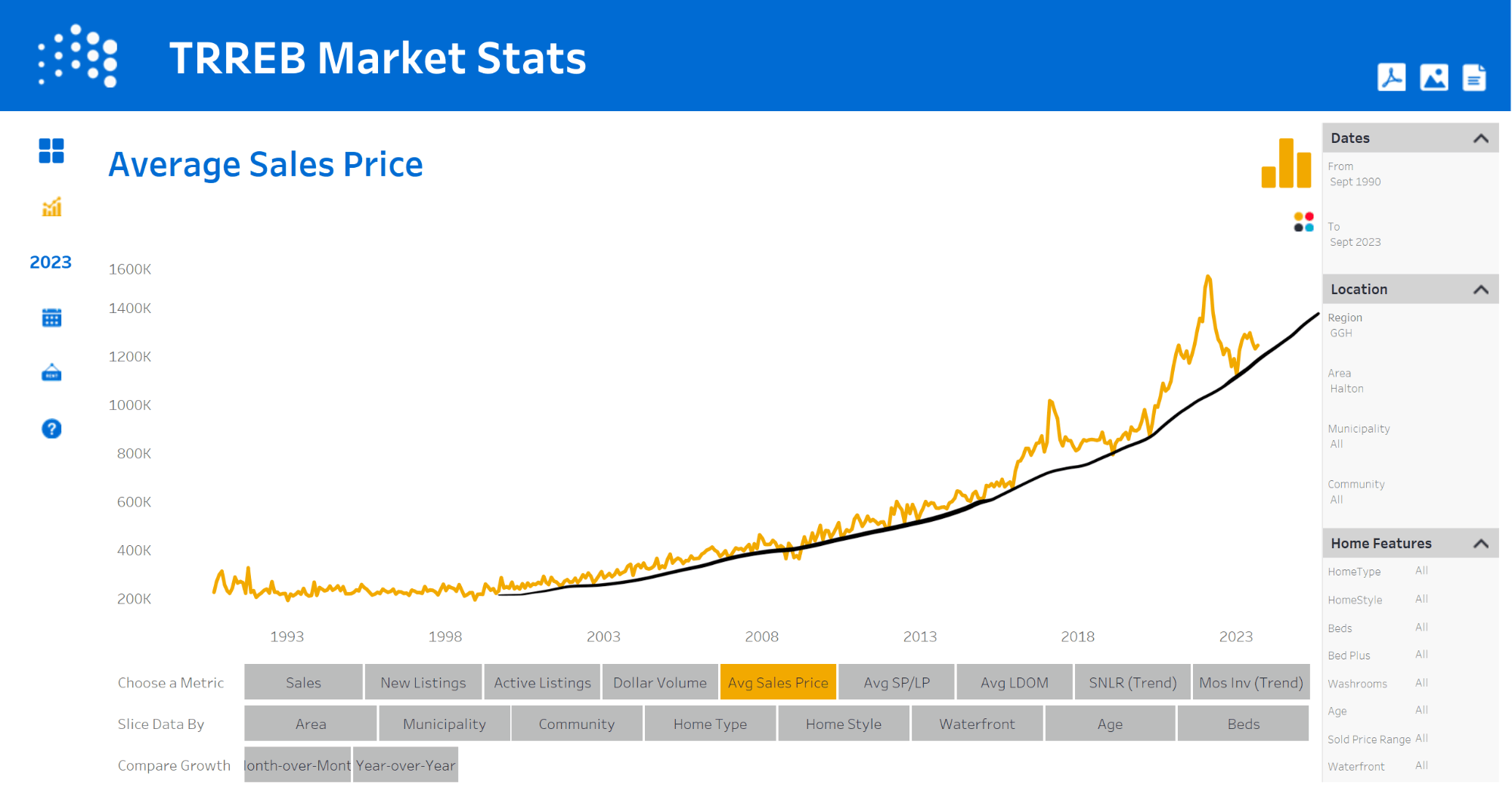

The graph below is the the history of the average selling prices in Oakville since 1993 and I drew the black trend line underneath. You can clearly see a correlation between the rate of immigration in the earlier graphs (they rose dramatically beginning in 2016 and again to a whole new level in 2022). Bear in mind our immigration targets for 2023, 2024, 2025, and 2026 are roughly 500,000 per year.

As you can see in this graph, the average sales price had been holding steady all year around $1,550,000, but in October dipped down to just under $1,400,000. The main contributing factor to this dip in the average sales price was the lack of sales in the higher price ranges. In September there were 24 transaction at or above the $3,000,000 mark compared to only 2 in October. This difference in average price does not have an affect on each individual home. If a detached home was worth $1,550,000 in September, it's still worth $1,550,000 today.

Months of inventory has been steadily climbing from the incredibly low levels it was at throughout the "Covid Years" and is now at a comfortably balanced level if you look at the combined level of inventory including all price ranges.

The sales volume dropped significantly and all of that drop was in freehold homes, meaning the condo sales numbers were relatively unchanged month over month.

Michael Englund

905-399-4269

Categories

Recent Posts