Cooling Inflation May Open the Door to Lower Rates—and More Buyers

Let’s break down this week’s Canadian inflation numbers and what they might mean for mortgage rates and the housing markets in Oakville, Burlington, and Milton in the months ahead.

The latest CPI reading came in at 1.7% year-over-year for May—same as April. That may sound uneventful, but it’s actually good news. It tells us inflation isn’t accelerating again, and that gives the Bank of Canada more room to continue cutting interest rates.

Core inflation also cooled off a bit—especially in areas like rent and travel—while gas prices remain well below last year’s levels thanks in part to the removal of the consumer carbon levy. That, combined with weaker-than-expected retail sales and a sluggish labour market, is reinforcing the idea that our economy is slowing just enough to keep inflation under control.

Here’s what it all means:

-

Variable mortgage rates could start trending lower if the Bank of Canada follows through with another one or two rate cuts this year (which seems likely).

-

Fixed mortgage rates—which are more tied to bond yields—are already showing signs of easing slightly.

-

Real estate demand could start to pick up as affordability improves and more buyers regain confidence.

-

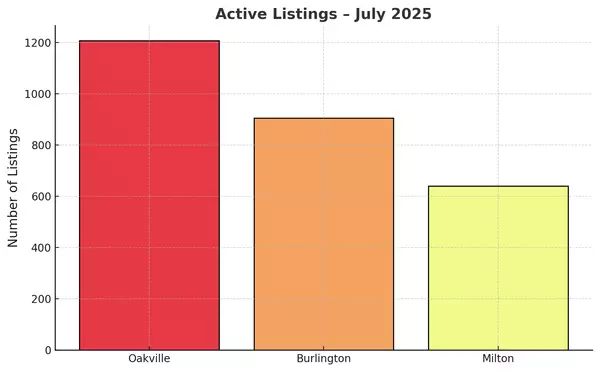

Supply vs. demand: We’ve had excess inventory in many areas lately, but increased demand driven by falling rates could help absorb some of that over the second half of the year.

This may mark a turning point toward a more balanced market. If you’re a buyer, now’s the time to keep a close eye on the trends. If you’re a homeowner thinking about refinancing, you’ll want to explore your options before rates shift again. And if you’re an investor, these changing dynamics could impact your next move in a big way.

If you have any questions about how this affects your mortgage or real estate plans—or just want to run some numbers—reach out any time.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts