Bank rate hold, sales volume increases and inventory level increases in Oakville, Milton, and Burlington

🎥 June 2025 Market Update with Michael Englund

The Bank of Canada held rates steady at 2.75% this morning, marking the second consecutive rate hold after seven rate cuts over the past year. They’re walking a tightrope—inflation is proving sticky and trade uncertainty is intensifying. The doubling of US steel and aluminum tariffs last week underlines just how volatile the landscape has become.

While the Bank is still expected to cut rates again—potentially twice more this year—they’re not rushing. Inflationary pressure from disrupted trade routes and rising input costs has made them cautious, even as the broader economy shows signs of softening.

🏡 Real Estate Market Update: Sales Rebound, Inventory Rising

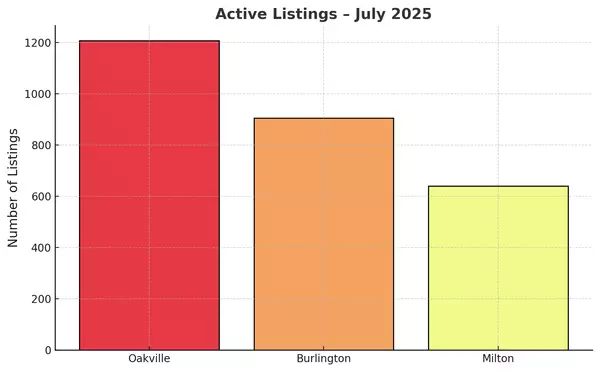

After a slower April, we saw a solid rebound in sales volume across the board in May. That said, inventory continues to build, giving buyers more options and leverage:

📍 Oakville

• Active listings: 1,430 (↑ from 1,317 in April)

• Sales: 308 (↑ from 224 in April)

📍 Milton

• Active listings: 697 (↑ from 640)

• Sales: 162 (↑ from 156)

📍 Burlington

• Active listings: 972 (↑ from 889)

• Sales: 256 (↑ from 209)

📌 What this means:

Sales volume jumped in May, but rising inventory is keeping the market from overheating. We're seeing more balance, more price negotiations, and fewer bidding wars—especially in the detached segment.

🎥 [Watch my short video above] for a full breakdown, including what the latest interest rate hold means for summer buyers and sellers.

📞 If you want to understand how this impacts your home or your plans to move, just hit reply or call my cell at 905-399-4269

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts