The GTA Housing Market: The Big-Picture Truth Behind Prices — And Why Smart Buyers Act Before the Crowd

The GTA Housing Market: The Big-Picture Truth Behind Prices — And Why Smart Buyers Act Before the Crowd

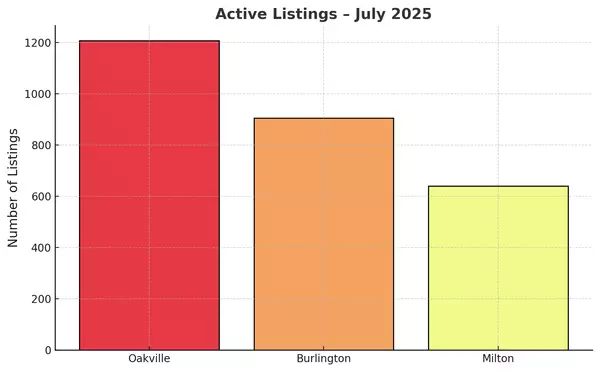

I speak with nearly a thousand people every month — homeowners and homebuyers from right across Oakville, Burlington, Milton, and the Greater Toronto Area. And I’m seeing the market split into two very different mindsets:

✅ Move-up buyers with equity and confidence are actively upgrading

❌ First-time and mid-range buyers are frozen by fear of the unknown

The headlines are loud. The opinions are louder. And for many, it feels safer to wait.

But here’s the thing most people aren’t seeing…

Why So Many Buyers Feel Confused Right Now

Monthly housing data without context is like reading one page of a novel and thinking you know the ending.

Interest rates, news cycles, election noise — they create short-term fluctuations.

But real estate — especially in the GTA — only makes sense when you zoom out.

A Growing Region With Nowhere Left to Expand

In 2005, the Province introduced the Places to Grow Act, which dramatically changed the future of housing supply in Ontario.

The purpose was good: smart, sustainable planning.

The impact? A massive constraint on where we can build.

From a development standpoint, Ontario became a man-made island:

-

No expanding outward into protected lands

-

Density required instead of new neighbourhoods on fresh ground

-

Supply permanently capped

Decades of Population Growth Have Changed Everything

At the same time supply was being limited, demand exploded — especially through meaningful immigration increases starting in the mid-1980s and accelerating into the 2000s and 2010s.

Take a look at this:

📈 GTA Population Growth

1971 → 2.63 million

2024 → 7.10 million

A more than 170% increase in people — living in the same (or actually less) finite area.

Housing Demand Here Isn’t Temporary — It’s Structural

More people arrive here every year.

Land isn’t being added.

This is the simplest economic force there is:

➡️ More demand + fixed supply = long-term upward price pressure

Even when the market slows temporarily, the fundamentals underneath don’t change.

That’s why long-term GTA real estate has proven itself again and again as a powerful wealth-building asset.

Move-Up Buyers Already Understand the Opportunity

While some buyers are paralyzed by uncertainty…

✅ Move-up buyers are quietly making their smartest moves during this calmer period

-

Less competition

-

Opportunities to negotiate

-

The ability to secure the right home while everyone else hesitates

They’re not guessing.

They’re looking at the fundamentals — and acting with confidence.

If You’re Ready To Buy, Focus on the Fundamentals

Whether you’re a first-time buyer or a future move-up homeowner:

-

Don’t chase hype

-

Don’t follow fear

-

Make decisions based on data and long-term reality

If you find a home you love and can comfortably afford, waiting for “perfect timing” can cost more than it saves.

Watch the Full Market Breakdown

I explain this entire dynamic — and what it means for your buying power today — in my latest video:

📺 YouTube: https://youtu.be/r0ETHZGrWMU?si=OauZKE20Qm0KHNKQ

Give it a watch — I think you’ll find it reassuring.

The bottom line here is that there will always be economic events that trigger uncertainty and bnuyer pullback, like higher interest rates and US Foriegn policy and foreign buyer's tax (and now foreign buyers ban) and recessions, and you name it, all of these types of economic events shock the market and scare buyers for a period of time, but in the long run it's crystal clear that buying property in the GTA has always been a rock solid investment (provided youu can afford it).

Ready to Make a Smart Move? I’m Here to Guide You.

Whether you’re just getting started or planning your next step up the ladder, you deserve clarity, confidence, and expert guidance.

Let’s talk about your goals, your timeline, and your best options in today’s market.

📲 Call or text: 905-399-4269

📩 michaelenglund@me.com

I’m here to help you own your future — one smart move at a time.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts