Don't believe the hype

Yes, interest rates have been going up, but prices have come down much more. Prices have come down by 23% from March 2022 to January 2023. You can use whatever price you want to do your own calculations, but I'm going to use the average selling price of $1,856,000 from March 2022 and 2.9% as the 5 year fixed rate back then versus today's average price of $1,380,000 and today's best 5 yr fixed rate of 4.39% offered by HSBC for my comparison:

March 2022 average price $1,856,000. Jan 2023 average price $1,380,000

2.9% mortgage 4.39% mortgage

20% down = $371,200. 20% down= $276,000

= $6,951/month = $5,168/month

Total Paid over 60 months= $417,047 Total Paid over 60 months=$310,089

Total Int paid $198,927 Total interest paid=$147,909

Balance $1,266,679 Balance=$941,820

A savings of $324,859 in payments plus another $95,200 of savings in the downpayment for a grand total of $420,059 in savings if you were to buy today compared to March 2022.

The popular concern these days is :

"The rate is going to come down next year so I think I'm going to wait for that."

When rates do come down, prices go up and prices move faster than rates (as shown in the above calculations).

"But what if the Bank of Canada brings down their rate to 3% in 2025 and I'm stuck paying 4.39% for another 3 years?"

If and when the Bank of Canada brings it's rate back down to 3%, the major banks will most likely want to make a spread so 4.39% might not be so bad at all, particularly considering you paid today's selling price instead of whatever the price might be in a market where interest rates are coming down and prices are rising.

Another factor that could have an impact on demand is immigration. The federal government has stated that they are focussed on catching up on a huge backlog of Permanent Residency applications. These people have been here for quite some time and many have down-payments and are ready to buy.

If you are downsizing to your "retirement" home, you may want to consider buying it now while you hold on to your current home and rent out your "retirement" home while you wait for the prices to come back up on your current home.

If you are buying your first home or upgrading to a bigger home, I believe that now would be a great time to do it.

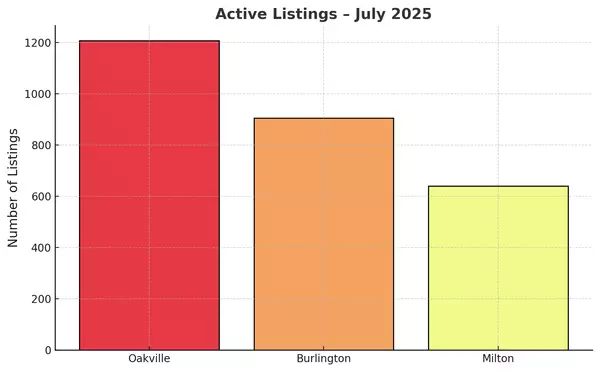

As you can see in this graph, we sold 122 properties in January at an average price of $1,381,445. We have 2.2 month's of supply and it takes an average of 36 days to sell a property.

Here is a timeline of what has happened since March 2017 which was the last time we had a market correction followed by a series of rate hikes lasting 16 months. As you can see, once people got used to the new rates and the rates stopped going up, prices eventually started rising once again, to a much higher level once rates started coming down,

This graph (above) shows Months of Inventory which is how many properties are for sale relative to how many properties are being sold in one month. While these levels have been rising since the rate hikes began, these levels are still very low in general which means that any slight reversal of momentum in our market will have a quick and meaningful impact.

This graph (above) shows you the monthly sales volume since March 2017 until today. You can see that every November to January we tend to have our lowest sales volumes no matter what the year. From February to June we have our busiest season. For any of you who have been out looking at properties in the last couple of weeks you can easily notice a big increase in showing activity and sales.

As you are watching the market and trying to figure out if a property seems like a good deal, it's important to know your numbers inside and out. The most important number I look at as a seasoned realtor is price per square foot. While it sounds like a simple equation to figure out, it's really not so simple and requires in depth knowledge of locations as well as build quality, and also knowing what properties and designs are most desirable. Here's a short video explain some of the differences:

Call or text me anytime if you would like to learn more about a specific property type and/or neighbourhood. 905-399-4269.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts