Renewing a mortgage after 5 years?

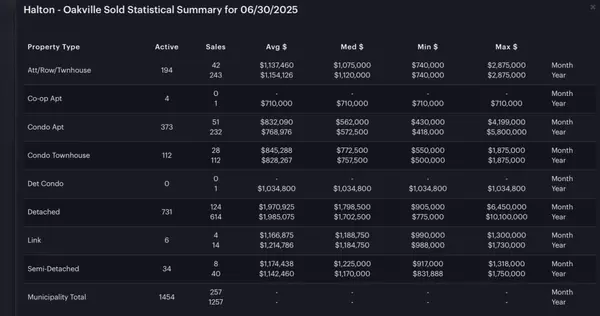

Much has been made of recent rate hikes all over the media lately with emphasis on people who are up for mortgage renewal now after 5 years at much lower rates. Let's take a look at the real numbers. 5 years ago the average selling price in Oakville was $1,093,000 in September of 2017 and the mortgage rates were 3.39% so with 20% down the monthly payment would have been $4,315/month. Once the 5 year term has been completed the balance owing would be $$752,906 after having paid off $134,233 in principle. Refinancing $752,906 at the current available mortgage rate of 4.9% the mortgage payment would be $4,331.00 on a variable or $4499/month at 5.29% on a 5 yr fixed rate. The worst case scenario here is only $184/month, just 4% difference, so where's the fire? The fire, my friends, lies in the group of people who have added on to their existing mortgages to finance home improvements or to consolodate other debts.

The good news is that from 2017 to now, the average prices have increased from $1,093,000 to $1,534,000 so there is significany equity that has been built up and thanks to the mortgage stress test this level of equity has been and will be largely preserved so we are still in very good shape and we look forward to several months of a balanced market ahead of us.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts