What happened? What's happening now? What will most likely happen?

With so many ways to get information about the real estate market these days, it's a very common feeling for people to be drowning in information but starving for clarity.

Each source of information has their own agenda. News companies sell news and want as many eyeballs and shares as possible and usually publish attention getting headlines and fantastic stories. This week I even heard that the real estate market was down 90%! What??? Ha ha ha. Sure. Good lord, get a grip.

What's my agenda? I want to provide facts and clarity to my past clients and my prospective future clients.

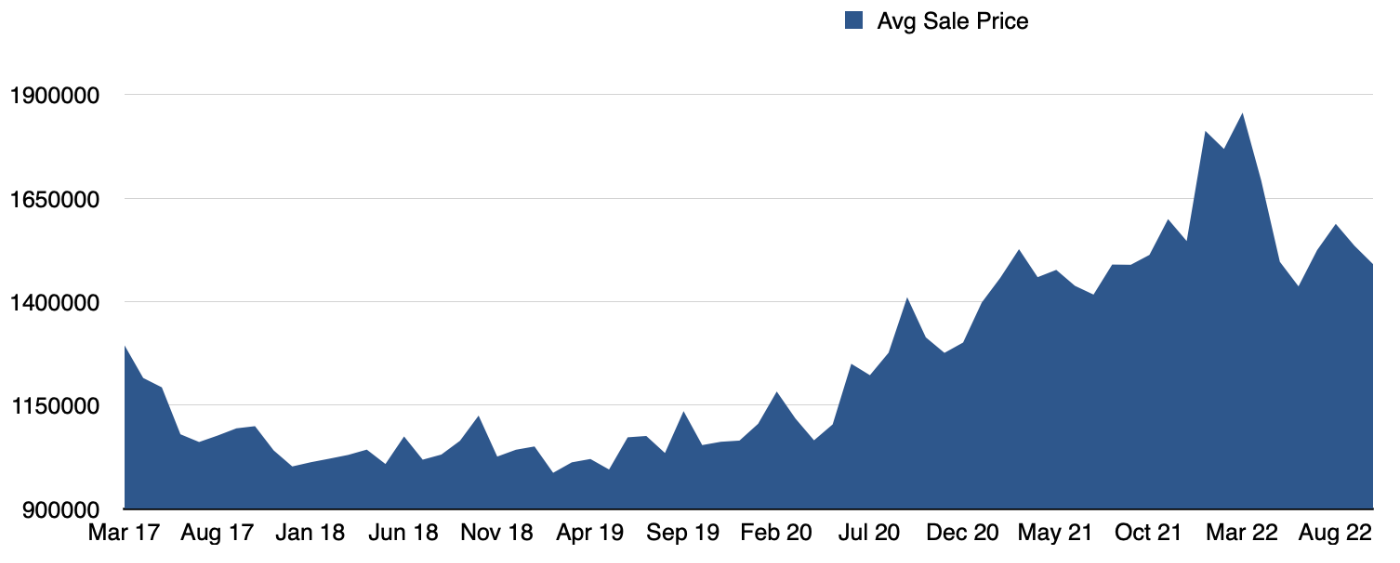

In order to try to predict what will happen next in the real estate market, I look at where we are in our cycle. A cycle that usually repeats itself, not exactly in every way, but in general. Most people think we are close to the end of our interest rate hiking cycle and I agree. Looking back at 2017/2018 which was our last rate hike cycle, it was quite different, we had 0.25% hikes that were much further spread apart. Our total increase was only 1.25% over the course of 16 months. This time around we have endured a total of 3.5% in hikes over only 8 months (twice as much in half the time), but we started from a 1% lower starting point because in March 2020 the BOC lowered the rate by 0.50 twice, so compared to October 2018 we are really only 1.25% higher at the moment. When we look at October 2018 (as the final month of rate hikes) and the 15 months following, the prices were relatively flat, the amount of inventory was really well balanced at an average of 3 months supply and the average volume was quite respectable as buyers and sellers were getting used to a stable and predictable environment in which to transact.

I think we will experience a 2023 that will be quite similar to 2018/2019 in that our rates won't change much at all and our buyers and sellers will have time to acclimate to the new realities of the market. I believe we will have two more rate hikes before we see the end of these rate hikes but I think they will be small enough to not have much effect on the average selling price, even though they will change affordability somewhat. Don't forget what I've been stating for many years now, our creation of new housing is far behind our immigration numbers. The time it takes to get a permanent resident card in Canada is now about 2 years and with a 25% tax on anyone without a PR card all of these newcomers are waiting it out, but they are here, they have money, and will buy when the PR cards are issued and Canada recently increased their immigration targets to meet labour demand.

There are many reasons for people to buy and sell real estate no matter what market we find ourselves in. People need to move for work, or to get children into a specific school zone, or finally being able to afford the dream house in the perfect neighbourhood, or a family break-up, or two families consolidating into one property from two separate ones, or disposing of a property following a death in the family, or selling to solve debt issues, or marriage, or being a first time buyer graduating from renting to owning.

Interest rates increase and decrease over time and always have an inverse relationship to real estate prices but one thing that has proven constant over time is that real estate values increase, so is it better to buy at a lower price with a temporarily higher interest rate or is it better to buy at a higher price with a temporarily lower interest rate? Based on what we have seen recently most people value lower interest rates over lower prices even though the math doesn't support that position. Similar to the stock market, the bulk of people tend not to buy stocks that are on sale and want to see clear confirmation of an upward trend before buying.

If you bought a detached house 10 years ago in Oakville for the average price of $930,000 it is now worth almost $1,900,000. If you bought that same house 5 years ago it would have cost $1,486,000 and is now worth $1,900,000. What do you think that house will sell for in five years from now?

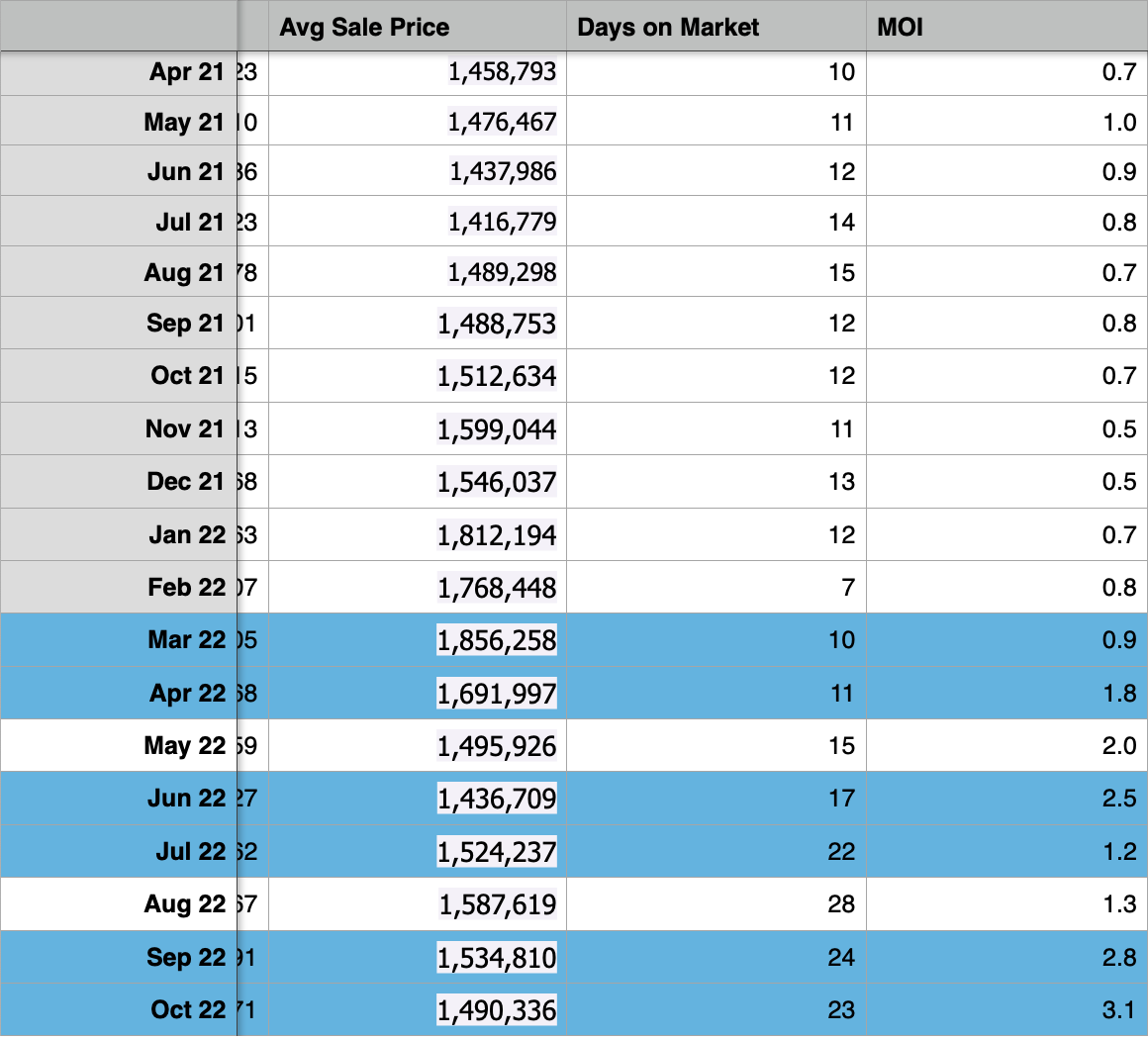

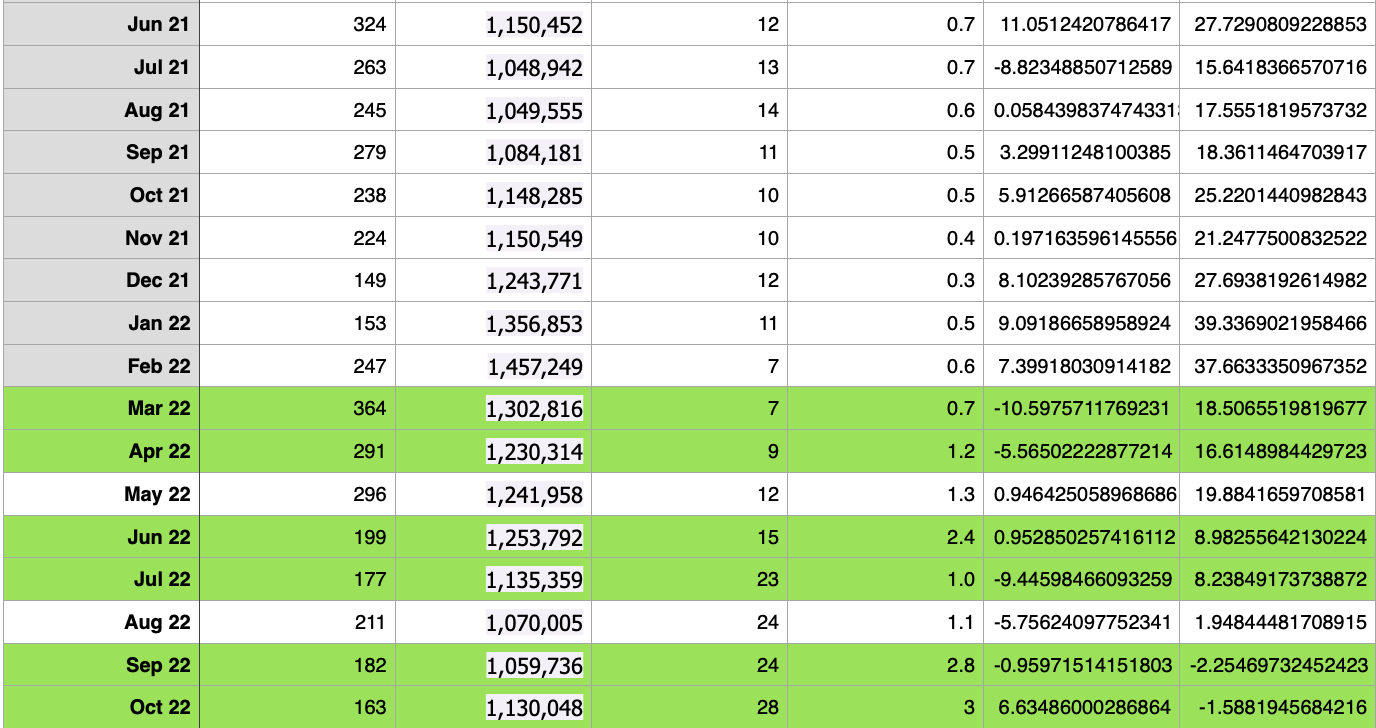

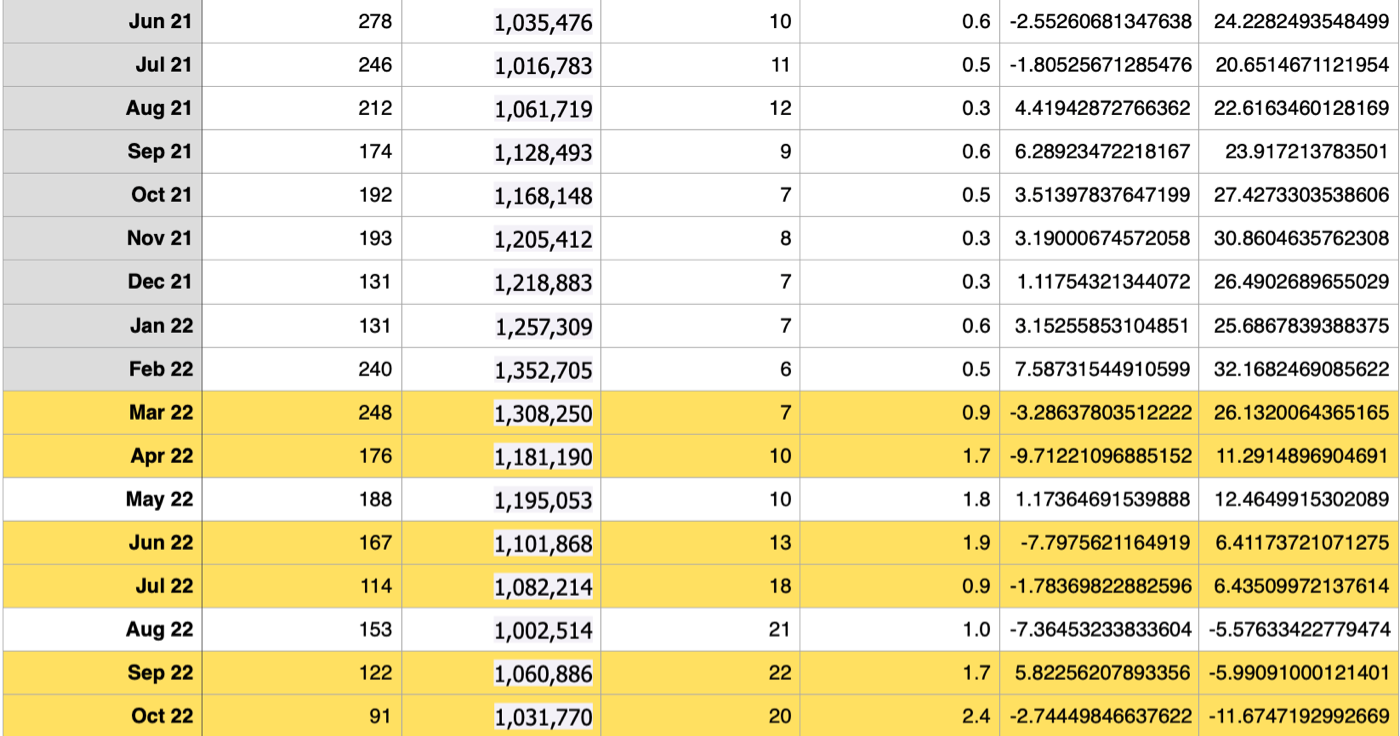

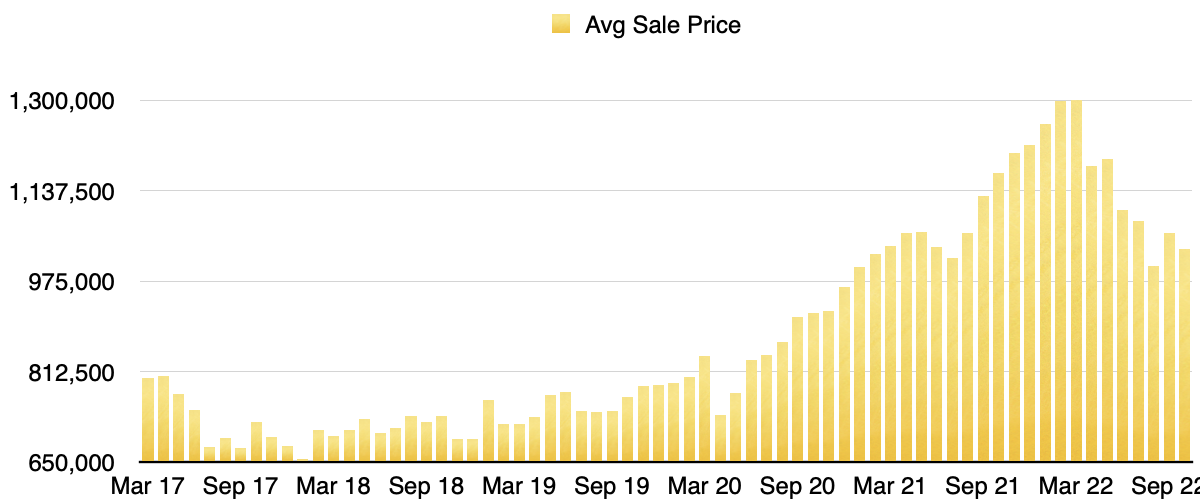

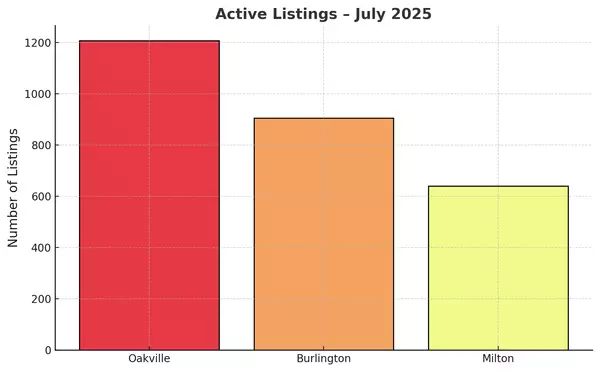

Watch the video if you would like me to take you through the graphs in detail, but long story short Oakville was down 3% in average sales price to $1,490,000 which is 1.5% lower than last October. We have 3.1 months supply in Oakville now. Burlington was actually up 6% from a month ago in average price to $1,130,000 but lower than last October by 1.5%. Burlington has 3 months supply now. Milton was down 2.7% from a month ago in average price at $1,031,000 and down 11.6% from a year ago. Milton has 2.4 months supply now. It looks like Milton is getting hit harder than Burlington and Oakville.

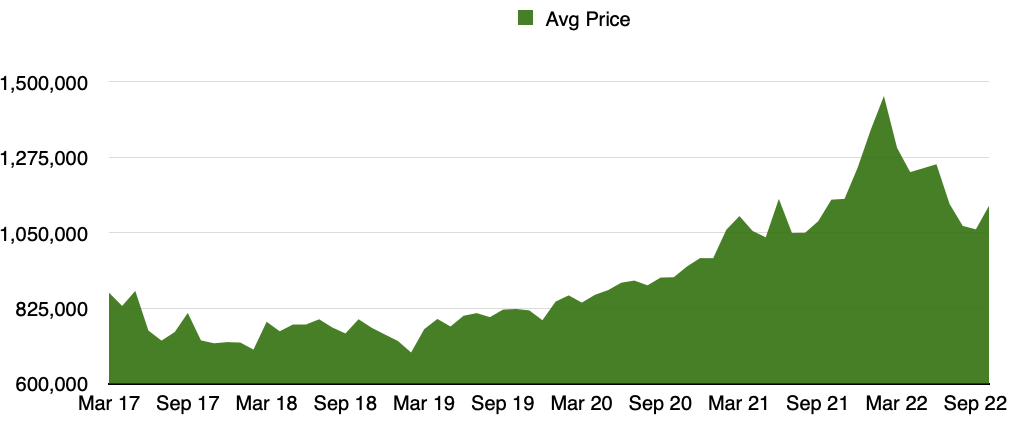

Here are the Oakville numbers:

Here are the Burlington numbers:

Here are the Milton numbers:

Determining budget usually comes down to 2 things, downpayment and monthly payments. Prices have come down significantly since their highest levels which were this past February and March to the point where down payments and monthly payments are actually lower now, even with higher interest rates, than what they were then. If you would like to do the math click here: MORTGAGE CALCULATOR.

If you or anyone you know is looking to buy or sell a house now or in the future, please reach out to me by phone at 905-399-4269.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts

The GTA Housing Market: The Big-Picture Truth Behind Prices — And Why Smart Buyers Act Before the Crowd

October 2025 Real Estate Market Update for Oakville, Burlington, and Milton

September 2025 Real Estate Market Update for Oakville, Burlington, and Milton

July 2025 Market Report: Why the Headlines Don’t Tell the Whole Story

Weekly Real Estate Market Snapshot: Oakville, Burlington & Milton – July 11, 2025

June 2025 Real Estate Market Update: Oakville, Burlington & Milton Breakdown

Milton Real Estate Update: Listings Up, Sales Soft

Burlington Real Estate: Balanced Market or Shift Incoming?

Oakville Real Estate Update: Buyers Have More Leverage This Week

Cooling Inflation May Open the Door to Lower Rates—and More Buyers