April 2021 Market Intelligence

| Still not nearly enough supply… |

| The markets are still on fire as predicted by yours truly. The senior economists from each of the major banks have finally caught on and are calling for government intervention to help cool the market. There have been all sorts of suggestions including capital gains tax on principal residences (I fail to see how this could help to cool the market, if anything we will see even less supply, not to mention how that will seriously derail the best laid retirement plans of the majority of Canadians.). Should this ridiculous idea come to fruition it would become vital to ensure your cost base is up to date and as high as it can be by keeping accurate records and receipts of every cost that has been spent on the home over the years. The most sensible suggestion include increasing the supply of new low density homes since the supply level is the bottle neck causing this hot market, and it has been for years. Another suggestion has been to make the bidding process open instead of blind, which would be more of a warm hug and a smile to make people feel better about their bids and still does not address the real issue which is and always has been a tremendous lack of supply. My sister is a high producing realtor in Sweden (where I’m from) and they have had an open bidding process there for many years and it does not at all contribute to more affordable housing. I would think most realtors would welcome this as it would remove the doubt that exists in the offer process. There are changes coming to the mortgage stress test as of June 1st 2021. The benchmark interest rate that buyers need to qualify for will jump from 4.79% to 5.25%. So if a buyer has a firm deal in place before June 1st, they will be qualified at the current 4.79%. As of June 1st that same buyer would need to be able to qualify at 5.25%. Even though it’s a prudent action designed to mitigate future defaults, the timing of this will have the unintended consequence of adding gallons of fuel to this fire. If you’re planning on buying a property this spring, I would recommend that the sooner you buy, the less you will pay. It seems as though for every potential buyer who loses interest in the process, there’s at least one or two more buyers who are happy to take their place.That’s what we are seeing “in the trenches” so to speak. Take a look at the graphs below and you will see the inverse relationship between supply (Months of Inventory) and Average Sales Price. It’s quite clear that we need more supply. Curbing demand is a very short term band aid solution that could easily backfire. Usually by the time you read about the market conditions of any market (real estate or otherwise) in the news it’s about 9 months later than when actual industry players started talking about it so stay tuned right here and I will do my best to give you better advice to get better results. |

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts

The GTA Housing Market: The Big-Picture Truth Behind Prices — And Why Smart Buyers Act Before the Crowd

October 2025 Real Estate Market Update for Oakville, Burlington, and Milton

September 2025 Real Estate Market Update for Oakville, Burlington, and Milton

July 2025 Market Report: Why the Headlines Don’t Tell the Whole Story

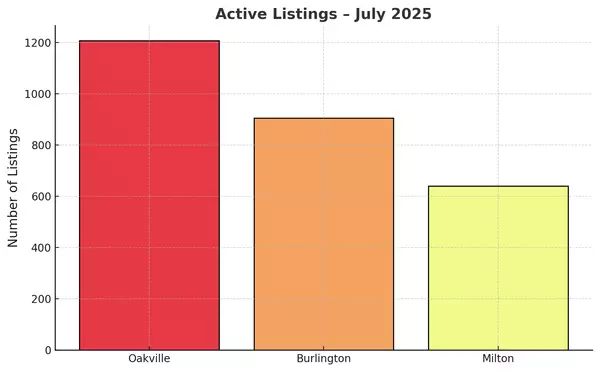

Weekly Real Estate Market Snapshot: Oakville, Burlington & Milton – July 11, 2025

June 2025 Real Estate Market Update: Oakville, Burlington & Milton Breakdown

Milton Real Estate Update: Listings Up, Sales Soft

Burlington Real Estate: Balanced Market or Shift Incoming?

Oakville Real Estate Update: Buyers Have More Leverage This Week

Cooling Inflation May Open the Door to Lower Rates—and More Buyers