February 2021 Market Intelligence

The Demand for Real Estate in Halton is Unmatched.

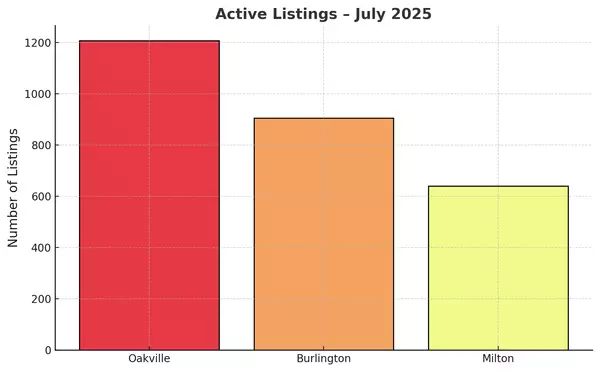

We are selling more homes than what is actively available on the market. Oakville sold 262 in January compared to 249 active listings (at the end of January). Milton sold 142 compared to 93 active listings. Burlington sold 183 compared to 167 active listings. Compared to one year ago Oakville sold 179 with 388 active listings. Milton sold 95 with 98 active listings, and Burlington sold 122 with 237 active listings. As you can see the demand and supply equation this year is vastly different from last year or any other year for that matter.

There has never been a seller’s market like this in my career. We came close to this in 2016/2017, but the provincial government intervened with their Fair Housing Plan which had the desired effect of cooling the demand. There were also a string of interest rate increases throughout 2017 and 2018 to help keep the demand at bay (those highlighted months in the graphs represent the last of the 5 rate hikes through that time period). After that however you can see the trend beginning where we see months of inventory (MOI) starting to decrease bit by bit, and sales volume increasing and average prices increasing. The only real blemish in that trend was the end of March and all of April 2020 during our first lockdown, but you can see that the market got right back on track very quickly.

This time around I do not believe that this provincial government is going to try to curb the demand for real estate since the real estate industry has become one of very few pillars supporting our pandemic riddled economy. I have heard rumblings that the Ford government is trying to increase supply by opening up parts of the greenbelt. I’m not sure how successful they will be in encouraging urban sprawl. Let’s say they do come up with an equitable plan to increase supply, it would take years to make this happen. The Bank of Canada has also stated that they will likely not raise rates until 2023 which would do little to discourage the demand for real estate. We have 150,000 people moving to the GTA every year and 30% of these people are buying real estate in their first year here. We have 50,000 millennials buying real estate for the first time every year. We compare these numbers to the paltry 27000 housing starts in the GTA in 12 months. These numbers do not add up to a balanced market and I fear that there is no quick fix to this. Another reason why Halton is favoured by buyers moving from Toronto and Peel is because of Halton’s low Covid numbers in comparison.

I have been standing in line ups to get in to see houses over the past month. Every single house I’ve sold or tried to sell have had multiple offers, in all price ranges. Prices have risen dramatically over the last three months alone. Yesterday’s reality is now history. The big question is where do we go from here? What will the market do next? Is this ridiculous rate of growth sustainable? What will trigger a more balanced market? Will it be a collective feeling of exhaustion and despair among buyers? Will that be all buyers or just the buyers who don’t have a house to sell? Back in 2017 that collective feeling of exhaustion and despair among buyers was nudged along by the introduction of the fair housing plan as discussed above, but that was in an election year when Kathleen Wynne was trying desperately trying to buy votes to help her stay in power. The political landscape has changed dramatically since then and I could not imagine Doug Ford intervening as mentioned previously.

Stay tuned. I will let you know once the number of offers on a single property drop to below 10 and then 5 hopefully. This may come as a surprise but most top end realtors actually dislike this type of market. We much prefer a balanced market where we can negotiate off the top and include conditions to protect our clients. While we all hope that the market returns to balance, it can be very expensive for a buyer to sit on the sidelines and wait it out. I haven’t seen a buyer’s market in my career since I started in 2012 and I see no reason why it would happen any time soon.

There are still ways to get a decent price in this market as a buyer, but it takes hard work and dedication, you might have to be a part of a few offer situations before you end up with what you want (also why most agents dislike this market). I cut my teeth in the car business over twenty years so I was used to making hundreds of offers every year. I’m not scared of making a few offers. Don’t fall in love with house until the day you move into it.

I remain dedicated to giving better advice as it leads to better results.

The average sales price was relatively unchanged from December 2020 to January 2021at an average of $973,793 but still an increase of 15% from last January. Burlington is a relative bargain compared to Oakville and Milton right now.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts