June 2020 Market Intelligence

CMHC Predictions and Mortgage Qualification Tightening?

By now you may have read in the news about the Canadian Mortgage and Housing Corporation (CMHC) and their prediction of a national slide in prices anywhere from 8-18% which of course does not sound very precise and understandably so as nobody really knows the exact toll the Coronavirus is going to take on our entire economy and our real estate industry. A few days after that announcement the CMHC made another announcement regarding any buyers who have less than 20% of the purchase price as a down payment, thus requiring the extra 3% insurance. The CMHC will as of JULY 1ST 2020 require a minimum of 680 as a credit score (up from 600) and a total debt service ratio of 42% instead of 44% which was the previous maximum. These new rules are not a very big difference and don’t effect a large number of people in the overall picture. Personally I think they can only be a good thing to help people not bite off more than they can chew.

I know I have said this many times, and I will keep saying it, over the long term the market prices increase by 5% per year. There are certainly some years where it’s much more than that and some years where we see a decline, but over the long term real estate is a solid investment, and if you have compelling reasons to buy or sell, you can do the right thing in any market.

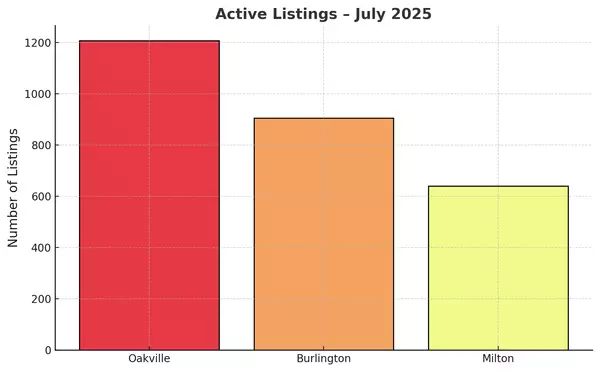

Oakville

After buyers in higher price ranges had a nice buying opportunity in April when months supply increased to 5.1 which was pretty close to a buyer’s market (a buyer’s market is defined as 6 months supply or more), the supply tightened back up in May due to more buying activity, which obviously raised our average prices up by 4% in one month. So we are still 10% higher in average price than we were last year at the same time. We are still far off normal seasonal sales volumes and understandably so with our most challenging times since I’ve been alive. The demand for real estate however, is undeniable. What I am noticing is that the sales volume is tied to what type of success we are having in our fight against Covid-19 and any further opening of the economy is spurring buyers ad sellers into action.

Milton

Milton also saw a rebound in sales activity in May from an almost standstill in April, and very tight on inventory still at only 1.5 months supply, very much a seller’s market with the average price heading back up towards $800,000.

Burlington

Burlington also dipped considerably in April and rebounded nicely in May and has even been able to reach a higher average price than February 2020 which was very high. Our last price correction started in April 2017 and bottomed out in July of 2017 and has been fighting it’s way back ever since through all types of obstacles such as 5 interest rate hikes, 2 mortgage tightenings and global health pandemic, and Burlington and Milton have climbed right back while Oakville is still a ways off from it’s lofty $1,300,000 average from 2017.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts