March 2020 Market Intelligence

Hi everyone, you are about to read about how hot the market is, and it is, but even in this hot market, there are deals to be had as a buyer (if you are my buyer), and even though it’s easy to sell your house in this market, how much you sell it for is the big difference that I can make for you.OakvilleAs stated in last month’s update, bidding wars are back in a big way. While they began lat last year in the lower price ranges, they have been creeping up into the mid range and the higher price ranges steadily, we are now seeing them all the way up to the $1,300,000 range (depending on the relationship of the asking price to the true market value of course). I have even seen a couple of multiple offers in the $2m plus price category. Many people, including some of my peers (to my surprise) think that this crazy market happened overnight. It did not happen overnight. It has been building since 2014 and hit a fever pitch in 2017 when the government stepped in with a series of legislation aimed at curbing demand (since they refuse to do anything to increase supply due to the greenbelt). The biggest hits the demand took was the Fair Housing Plan in April 2017, a series of 5 interest rate increases in 15 months, and finally the mortgage stress test that came out in January 2018 which forced every buyer to be approved at 2% higher than what they were being offered by the banks (so people could withstand further rate increases). So when you look at these graphs, you can easily see how the demand has been impacted by this government intervention and how resilient the demand has been throughout. Buyers who were impacted by the mortgage stress test have had 26 months to save up, a huge increase in immigration to the GTA has brought in additional buyers, millennials are buying 50,000 homes every year now, the Bank of Canada just lowered it’s overnight rate by 0.50%, and to top it all off, the Coronavirus is also playing a role in increasing demand for real estate among investors who are pulling out of equities in favour of more stable investments such as real estate.

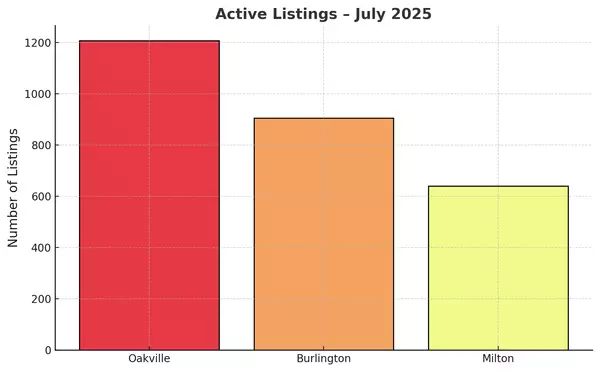

In Oakville the demand (or sales volume) hasn’t seen a February this busy since 2017 and because of that we are back down to less than 2 months supply (1.5) which puts an enormous upward pressure on prices like in 2017. With 302 sales this February compared to 158 last February, that’s a 91% increase in volume, while the average sales price increased from $986,000 last February to $1,182,731 this February which is a 19% price increase year over year.

Burlington

Burlington is also continuing with a strong pace with 203 deals in February 2020 compared to 151 last year which is a 34% increase in sales volume. The number of new listings did not increase hardly at all so the months supply in Burlington was down to 1.3 months which in turn put lots of upward pressure on prices bringing them up to $862,960 for February 2020 compared to $692,680 last February which is a 24% price increase year over year.

Milton

Milton’s volume is up 26% from 142 last year to 179 this February. Months supply did not come close to keeping up with demand is back to 2017 levels at 0.8 months supply, contributing to a price increase of

12% year over year to $803,265 which we have not seen since April 2017.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts