Bank of Canada rate hike

Today the Bank of Canada (BoC) made its decision to only raise the overnight rate by 0.50%, while the majority of economists were expecting 0.75%. 🏠

The major news here is the Bank's lowered outlook on Canadian inflation over the next two years. The BoC now projects the Consumer Price Index to come down to 4.1% (from 6.9% currently) by the end of 2023 and eventually right back down to 2.2% by 2024 where the BoC wants to be.🙏

What does this mean for real estate? Quite a lot. This is a major change in attitude from the BoC and signals the end of our current cycle of rate hikes is near. In a stable rate environment, buyers and sellers get acclimated to the current rates and our market stabilizes. What is a stable market? In my opinion it is a market that is quite balanced in terms of the number of sellers to the number of buyers and that there is a level of confidence that there are less variable factors involved in the decision making process. This type of market provides a more predictable environment to make one of the largest transactions in our lives.

Clearly my tone is one of optimism, and why not? With all the crazy stuff going on in the world today, optimism and positivity will win (provided it's backed up by logic and ability). ✊✅

Now is a great time to talk about real estate, even you are several months away from making a decision, or know someone who is. You can never be too prepared. Call me any time at 905-399-4269.

Categories

- All Blogs 100

- bank of Canada 34

- Bronte Oakville Real Estate 30

- Burlington Real Estate Market 1

- Fear vs Opportunity 1

- Home prices in Burlington 26

- Home prices in Milton 26

- Home Prices in Oakville 35

- interest rate 32

- Milton Real Estate Market 1

- mortgage renewal 28

- Oakville Real Estate Agent 13

- Oakville Real Estate Market Trends 10

- Real Estate Market Update Oakville Burlington Milton 19

Recent Posts

The GTA Housing Market: The Big-Picture Truth Behind Prices — And Why Smart Buyers Act Before the Crowd

October 2025 Real Estate Market Update for Oakville, Burlington, and Milton

September 2025 Real Estate Market Update for Oakville, Burlington, and Milton

July 2025 Market Report: Why the Headlines Don’t Tell the Whole Story

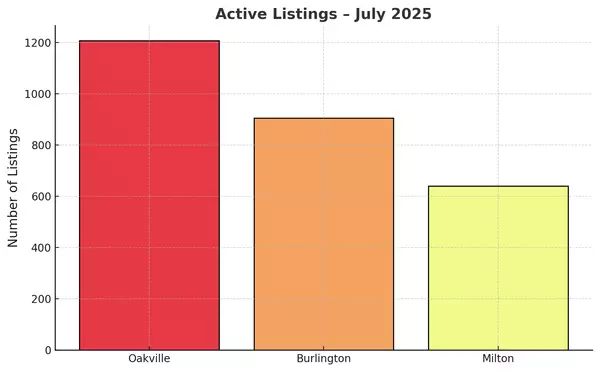

Weekly Real Estate Market Snapshot: Oakville, Burlington & Milton – July 11, 2025

June 2025 Real Estate Market Update: Oakville, Burlington & Milton Breakdown

Milton Real Estate Update: Listings Up, Sales Soft

Burlington Real Estate: Balanced Market or Shift Incoming?

Oakville Real Estate Update: Buyers Have More Leverage This Week

Cooling Inflation May Open the Door to Lower Rates—and More Buyers